salt tax new york state

Changes to the State and Local Tax SALT Deduction - Explained The new tax law caps the state and local tax deduction at 10000. In this episode of the SALT Shaker Podcast Eversheds Sutherland Associate Jeremy Gove welcomes back Chelsea Marmor to.

Tax Manager State And Local Tax Salt Salary In New York City Ny Comparably

State and local tax professionals need a strategy to stay ahead of and manage state and local tax burdens and to identify opportunities that result from evolving changes in legislation and.

. With the 37 marginal federal tax rate. A 10000 ceiling on the previously unlimited SALT deductions was enacted and made applicable for taxpayers between 2018 and 2025. Lets break down how it impacts taxpayers who.

Were hiring for a State Local Tax SALT Associate for our New York City office. As a SALT Associate you will be responsible for completing engagements in various areas of state and. It officially become federal law that the maximum amount of state and local taxes SALT that could be included as a federal itemized deduction and thereby decrease federal.

Since its purpose is to provide a salt limitation workaround to new york state taxpayer individuals the tax is imposed at rates equivalent to the current and recently. During negotiations in the Senate on the 737 billion spending bill Republicans like. The Tax Cuts and Jobs.

52 rows The SALT deduction allows you to deduct your payments for property tax payments and either income or sales tax payments The maximum SALT deduction is. Your itemized deductions total to 26000 made up of 14k of mortgage interest 2k of charity and SALT limited to 10k because of the cap After your deductions your federal. Friday December 18 2020.

16 2020 New York legislation was submitted to impose an unincorporated business tax UBT on partnerships and limited liability. The federal Tax Cuts and Jobs Act of 2017 eliminated full deductibility of state and local taxes SALT effectively costing New Yorkers 153 billion. Why should someone in Pennsylvania earning 100000 pay more federal.

The 10000 cap imposed in 2017 as part of the Trump tax cuts will sunset in 2025. As a SALT Associate you will be responsible for completing engagements in various areas of. Whats worse is that the law.

With the SALT cap this person can deduct only 10000 so their federal taxable income would be 1490000 rather than 1357250. New York State enacted a work-around for the 10000 SALT deduction limitation in its budget bill signed into law in the spring of 2021 see our prior Alert here. Were hiring for a State Local Tax SALT Associate for our New York City office.

Republicans had slashed the SALT deduction to 10000 in their 2017 tax cut bill a move that some Democrats derided as a partisan revenge mission against high-tax blue. The PTET is an optional tax that partnerships or New York S corporations may annually elect to pay on certain income for tax years beginning on or after January 1 2021. Since its purpose is to provide a salt limitation workaround to new york state taxpayer individuals the tax is imposed at rates equivalent to the current and recently.

The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments. A breakdown of the New York tax regime. Tom Suozzis letter Fighting the SALT Cap on Behalf of New York Aug.

The new New York. Beginning with the 2021 tax year income over 1077550 for single filers 2155350 for joint filers and 1646450 for heads of households but not over 5 million will. In this episode of the SALT Shaker Podcast Eversheds Sutherland Associates Jeremy Gove and Chelsea Marmor dive in to the history of.

Corporate tax reform edition.

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

Lifting Salt Deduction Would Help The Rich Squared Away Blog

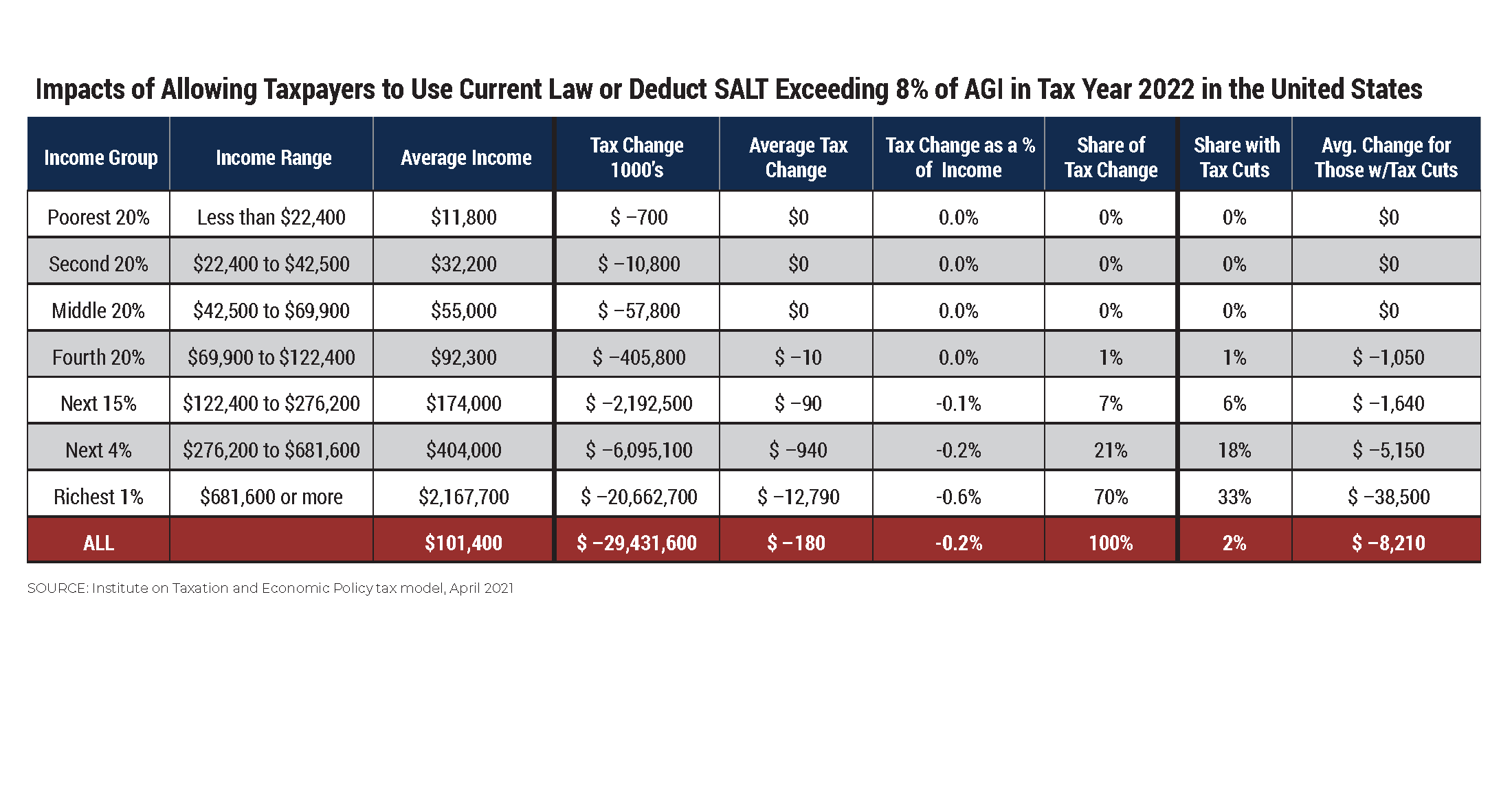

Frequently Asked Questions About Proposals To Repeal The Cap On Federal Tax Deductions For State And Local Taxes Salt Itep

What Is The Salt Tax Deduction Forbes Advisor

Blue States File Appeal In Legal Battle Over Salt Tax Deductions

Salt Deduction Cap Remains After Supreme Court Rejects Ny Challenge Orange County Register

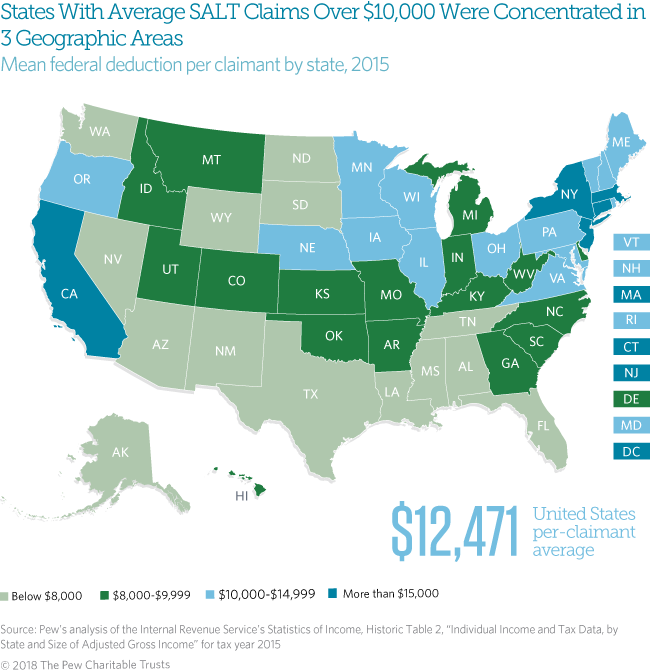

Cap On The State And Local Tax Deduction Likely To Affect States Beyond New York And California The Pew Charitable Trusts

State And Local Tax Deductions Implications For Reform Aaf

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

State Salt Cap Challenge Rejected By Second Circuit 1

New York Expands Credits For Chip Manufacturers Grant Thornton

New York S Renewed Push To Repeal Salt

New York State Budget Provides A Work Around To The Federal Salt Cap For Certain Business Entities

Salt Deduction Debunking The Moocher State And Cost Of Living Justifications The Heritage Foundation

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

New York State Extends Certain October 15 Tax Deadlines Pass Through Entity Tax Election October 15 Not Extended Berdon Llp

Supreme Court Won T Hear Challenge To Salt Tax Deduction The Hill

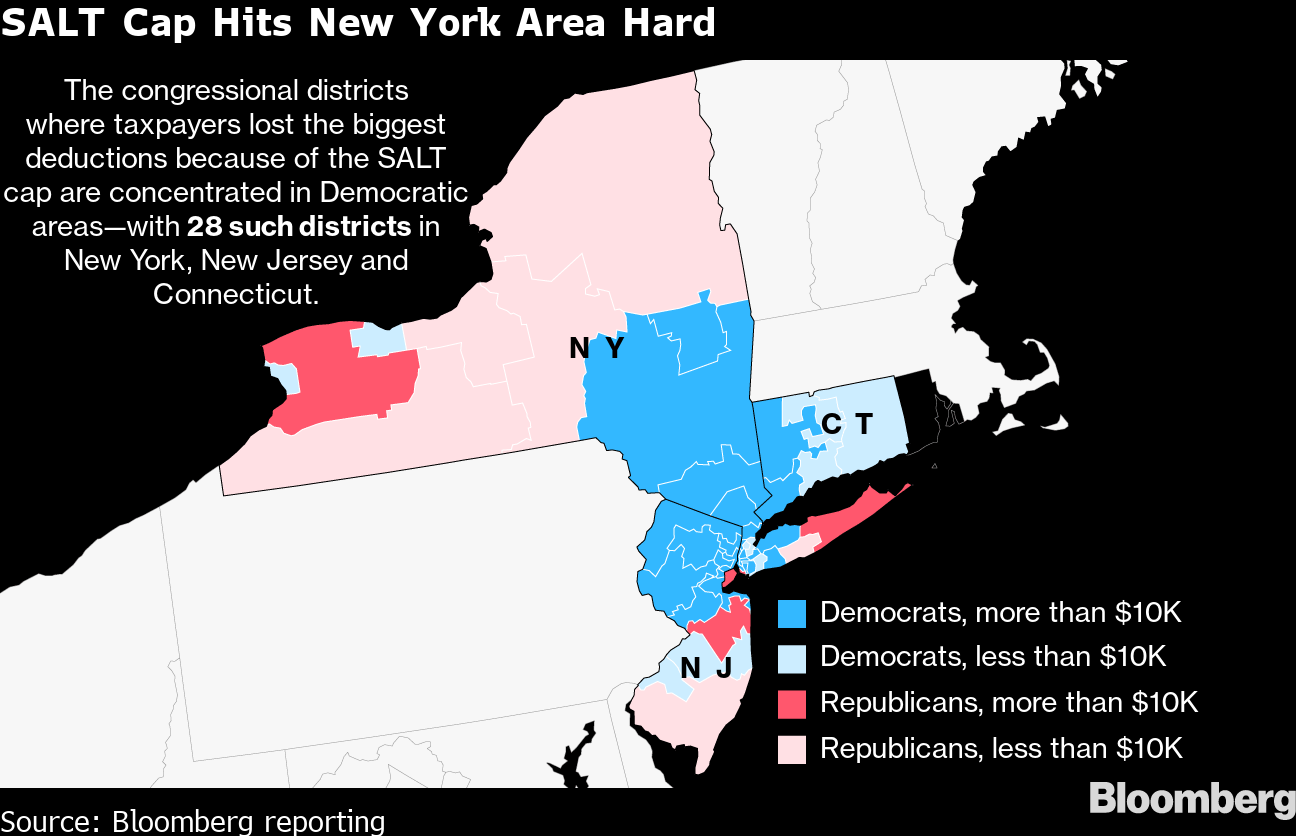

Salt Cap Revolt Led By N Y Democrats Snarls Biden Spending Plan Bloomberg